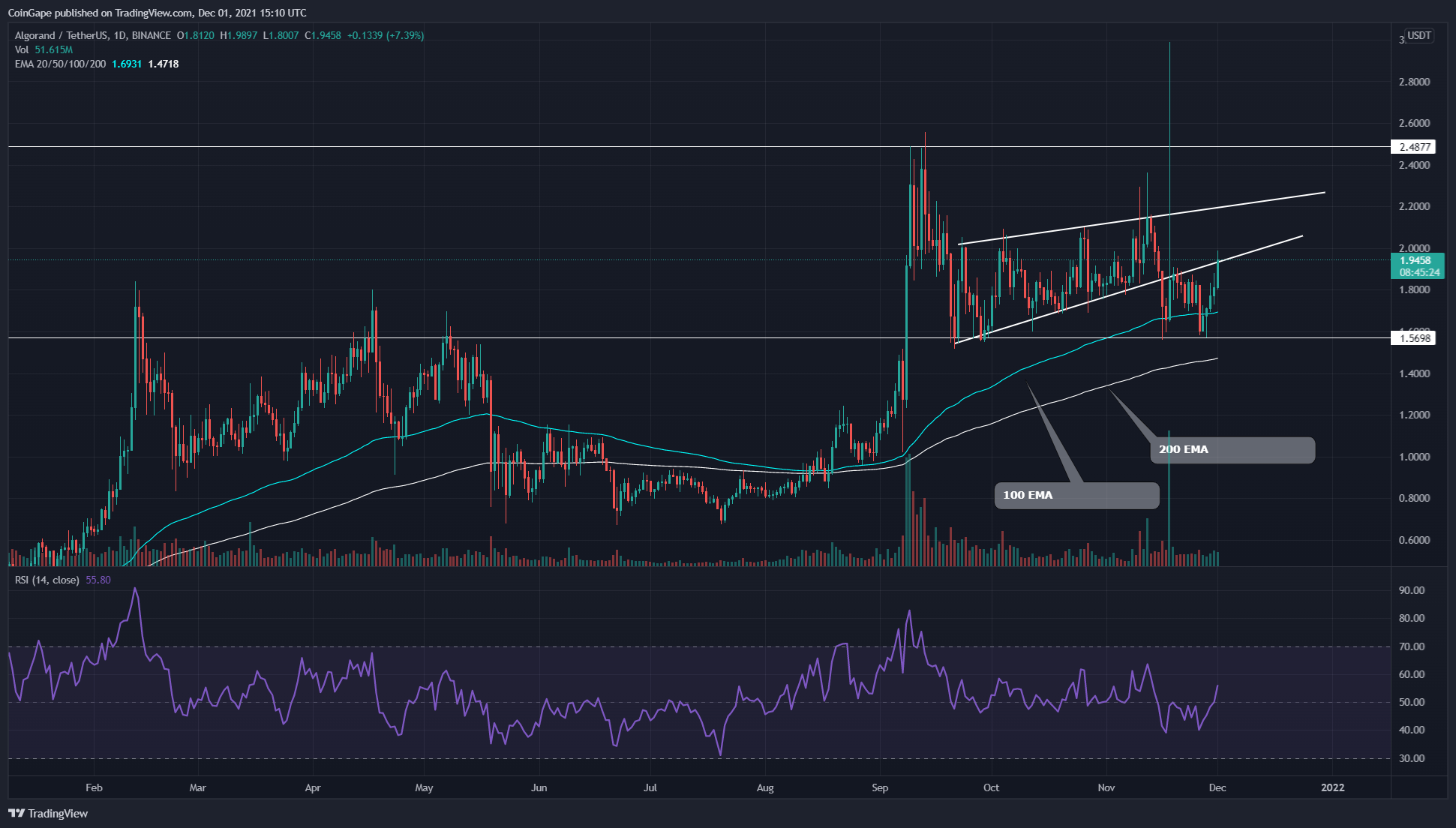

Algorand (ALGO)continues to show an overall bullish trend on the technical chart. ALGO price has recently bounced back from the critical support level of $1.56 and now with a ‘double bottom’ pattern signaling a possible rally in the catching trading session. Those who take a ‘long position’ should pay attention to the resistance levels.

Important Technical Points:

- ALGO price recently bounced back from the $1.56 support level.

- ALGO price is close to retracing the 50-day EMA line.

- The intraday trading volume of the coin stands at $737.6 million, up 68.18%.

The ALGO/USD chart has marked the price “echoing” in an ascending channel pattern on the daily time frame. On November 16, ALGO price dropped steadily from the support trendline, indicating a huge short opportunity for crypto traders.

ALGO Although its price gave a good retest to the new resistance trendline, the coin failed to break past the key $1.56 support level, creating significant demand pressure below that level.

The Relative Strength Index (56) has shown an impressive rebound on a recent bullish reversal from bottom support.

ALGO/USD 4-Hour Chart

ALGO showed a “double bottom pattern” on its 4-hour timeframe chart. However, in addition to the neckline of the $1.56 mark, this coin will also face resistance from the ascending trendline that previously provided good support in a parallel channel.

Moreover, the price has already made a breakout from these resistance levels and if the price sustains well above them, traders can get a good entry opportunity to continue long.

Also, traders can wait for the next level of resistance for the price to be $2.1 followed by $2.28.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.