In the last few weeks, the cryptocurrency market has seen Bitcoin and some high-end Altcoins It came under selling pressure as the . There is a lot of uncertainty regarding macro developments and the ongoing US debt ceiling negotiations.

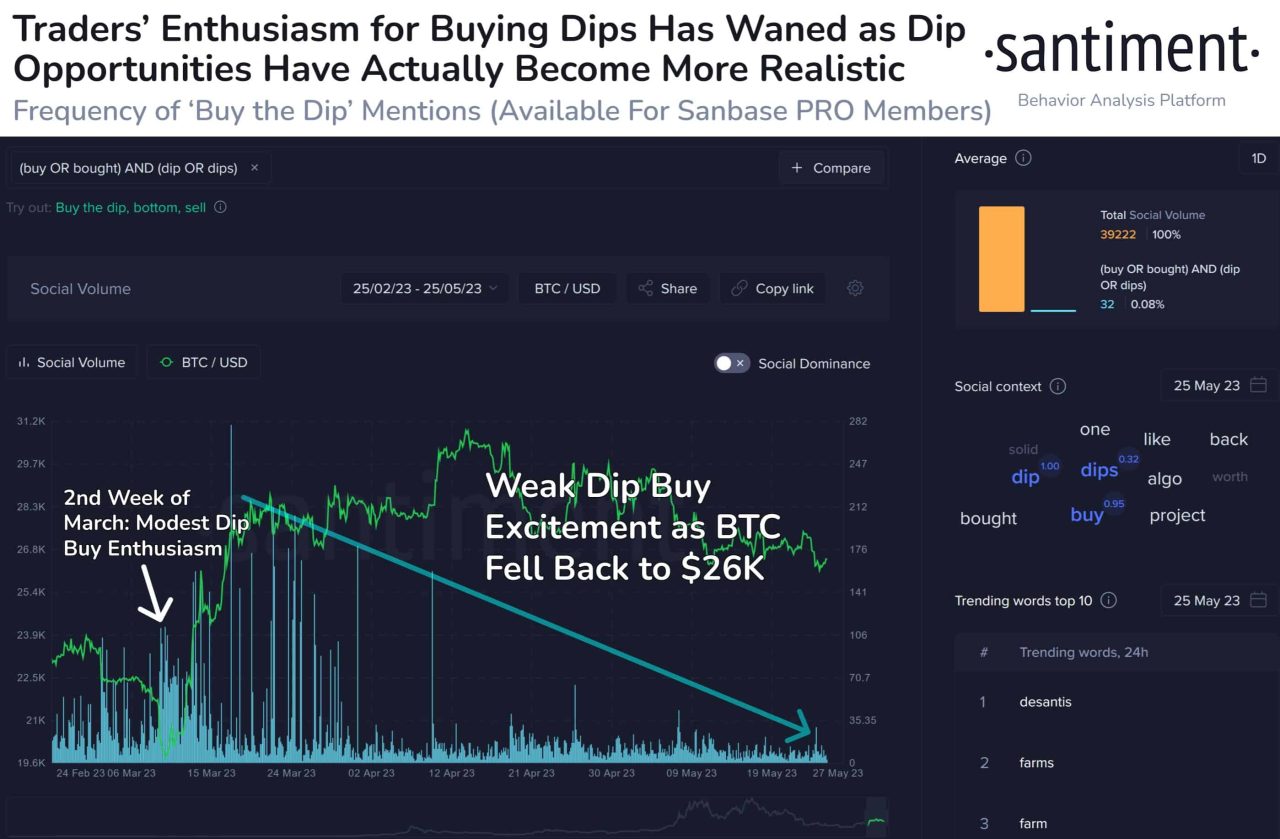

On-chain data provider Santiment shows that as bottom opportunities become more realistic, traders’ enthusiasm to buy bottoms is waning.

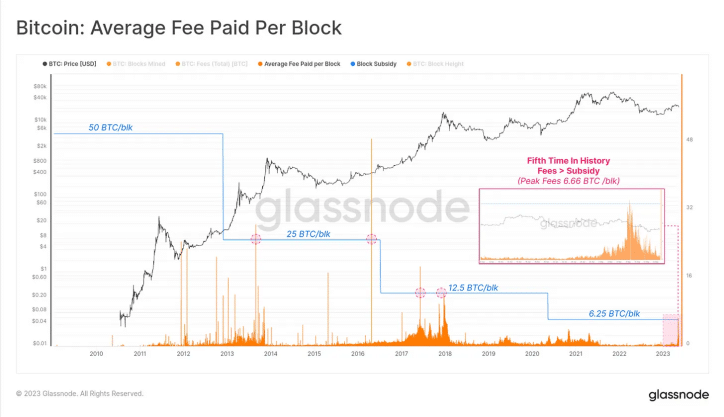

On the other hand, bitcoin It seems that miners continued to add throughout the month of May. Data from Glassnode shows that after the FTX crypto exchange boomed, miners expanded their balance sheets by 8,200 Bitcoins, with their total holdings approaching 80,000 BTC.

Also, during the month of May, Bitcoin miners earned a total of 12.9 BTC in mining rewards per block. For only the fifth time in history, Bitcoin miners’ fee revenues have exceeded subsidies.

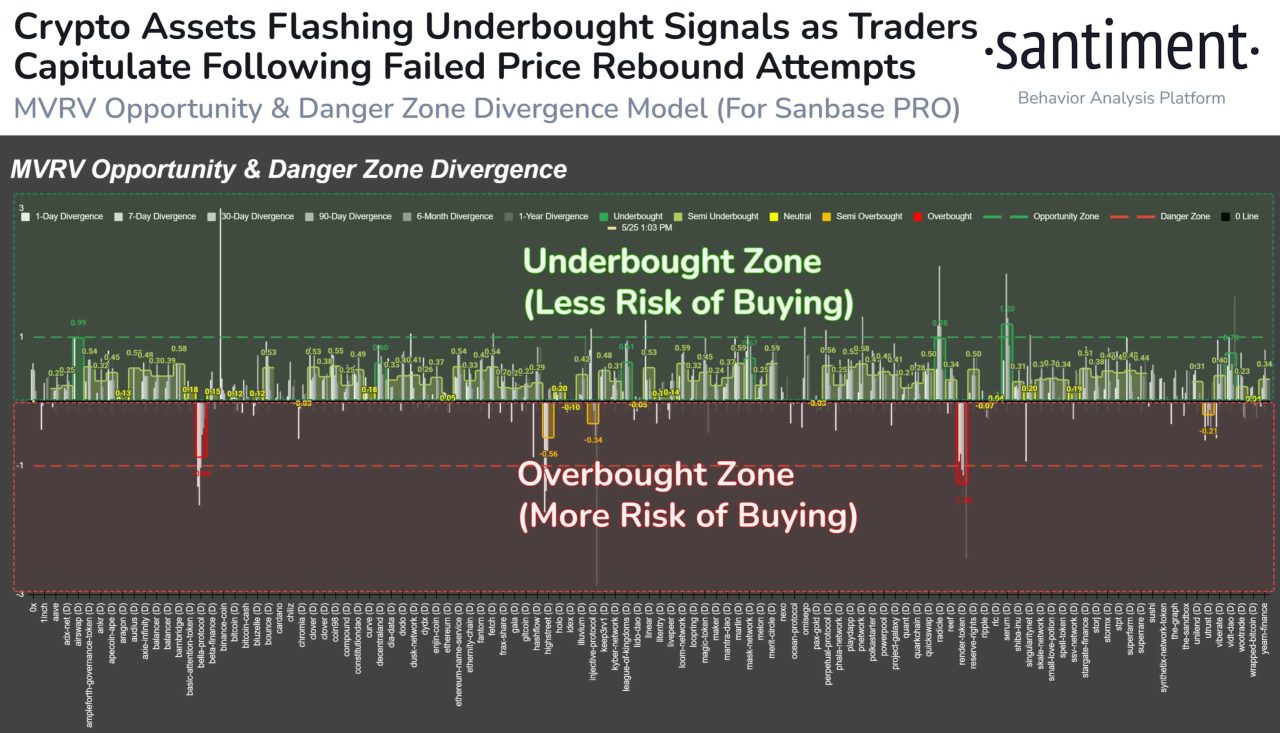

Flash Low Buy Signals on Altcoins

As the Bitcoin price remains under selling pressure, traders’ attention has now shifted to altcoins. Santiment reported:

Koinfinans.com As we reported, while the markets seem boring to their traders, we continue to see restless addresses emptying their wallets and selling at a loss. Our MVRV model shows that the vast majority of altcoins are giving low buy signals across the industry.

Other popular crypto- Some market traders also state that now is the time to buy altcoins. Popular crypto analyst and EightGlobal founder Michael Van De Poppe recently tweeted: threw:

It’s time to save up for altcoins. Time to buy these positions a year before the halving. A significant level has been reached here, which is about 1 year before the halving.

Still a weekly bullish divergence on Others.Dominance chart.

The previous time in the cycle, which was approx. 1 year before the halving of $BTCaltcoins also bottomed. pic.twitter.com/ths42Noyza

— Michaël van de Poppe (@CryptoMichNL) May 25, 2023

Some altcoins such as Litecoin (LTC) are already showing strength. Before the current pullback, LTC price rallied above $90 on the bullish momentum driven by the upcoming halving event.