The legendary investor has gone from being a skeptic to a buyback fanatic.

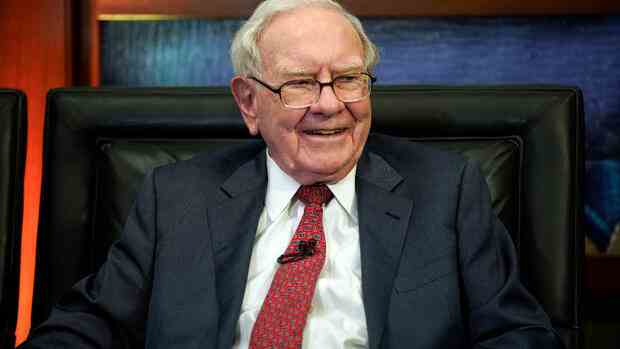

(Photo: AP)

new York For some they are balm for the depot, for others they are devil’s stuff that destroys innovation and jobs. We’re talking about share buybacks. In the USA, new records are fueling the debate about the controversial instrument. US President Joe Biden is involved, as is star investor Warren Buffett. An overview.

What are share buybacks and why are they so popular?

Share buybacks are a common practice. Companies want to artificially reduce the number of shares. For the remaining shareholders, this means that their percentage share in the company increases and with it their participation in the distributed dividend. Both usually drive up the stock price.

This year, buybacks from S&P 500 companies could top $1 trillion for the first time. In 2021 it was $850 billion, in 2022 more than $900 billion.

What are the critics of share buybacks saying?

Opponents of share buybacks argue that these only serve to maintain prices in the short term. Companies should rather put their profits into research and development in order to secure their future and thus jobs in the long term.

“Buybacks remain an important reason for job insecurity, income inequality and vulnerability in production in the US economy,” criticizes William Lazonick, the best-known researcher on the subject, in an interview with the Handelsblatt.

>> Read about this: New record – corporations buy their own shares for almost a trillion dollars

The University of Massachusetts professor emeritus criticizes the fact that companies have been focusing on the financial markets for decades instead of their core business and innovations. “And it’s only going to get worse,” he says with conviction.

What does the example of the chip industry show?

The economist Lazonick cites the example of the semiconductor industry, which now needs massive support from the US government: If Intel hadn’t put most of its profits into dividends and share buybacks over the past two decades, the group would be in place of TSMC and Samsung today Market leader, argues Lazonick.

Lazonick calculates that Intel has invested the majority of its profits in dividends and buybacks over the past two decades, while Samsung and TSMC have invested a much smaller percentage. Between 2003 and 2022, Intel distributed 91 percent of its earnings to shareholders, compared to only 29 and 48 percent for its competitors. They would have kept the profits in the company and invested more in research and development – and would be in a better position today.

The economist also criticizes the iPhone manufacturer Apple: “If Apple had invested even a fraction of the 573 billion dollars it blew out for share buybacks in state-of-the-art production, then TSMC would not have the power it has today, and the US would not depend on him for the most advanced chip production.”

How does Joe Biden handle stock buybacks?

The US government has taken Lazonick’s studies to heart. Last year, she pushed through the 1 percent tax on buybacks. In his recent address to the nation, President Joe Biden even called for this to be increased to four percent. However, this is unlikely to be enforced in Congress.

In addition, this week Biden tied government aid under the so-called “Chips Act” to companies refraining from buybacks.

>> Read more about: Biden ties aid for the chip industry to conditions

What does star investor Warren Buffett say about this?

The head of investment holding Berkshire Hathaway has long been an opponent of share buybacks. It wasn’t until 2011 that he launched his own limited program because the holding company was making so much money that he couldn’t find any worthwhile investments.

But Buffett is now completely in the camp of buyback fans. This is shown in his most recent letter to shareholders, in which he settled accounts with critics of buybacks. In it, the 92-year-old writes, “When you are told that all buybacks are bad for shareholders or the country, or particularly beneficial for CEOs, you are either listening to an economically illiterate or an eloquent demagogue (characters that are not mutually exclusive). .”

More: Stock buybacks and peanut brittle — highlights from Buffett’s letter to shareholders