USAWith the low inflation data from , the 9-month upward trend in the Dollar index was broken.

Expectations that the FED would slow down the rate of increase in interest rates and keep them at these levels for a while increased the interest in risky assets again.

FTX news just as everything is going well in the global markets bitcoinAlthough it has reduced the interest in , many indicators remain in the historical buying zone.

No one knows what kind of domino effect will occur after FTX’s bankruptcy. Therefore, risk appetite in cryptocurrencies may remain low for a while.

In this article, we will discuss the latest situation in indicators that show that Bitcoin is at historical lows, regardless of the turbulence that FTX may create in the short term.

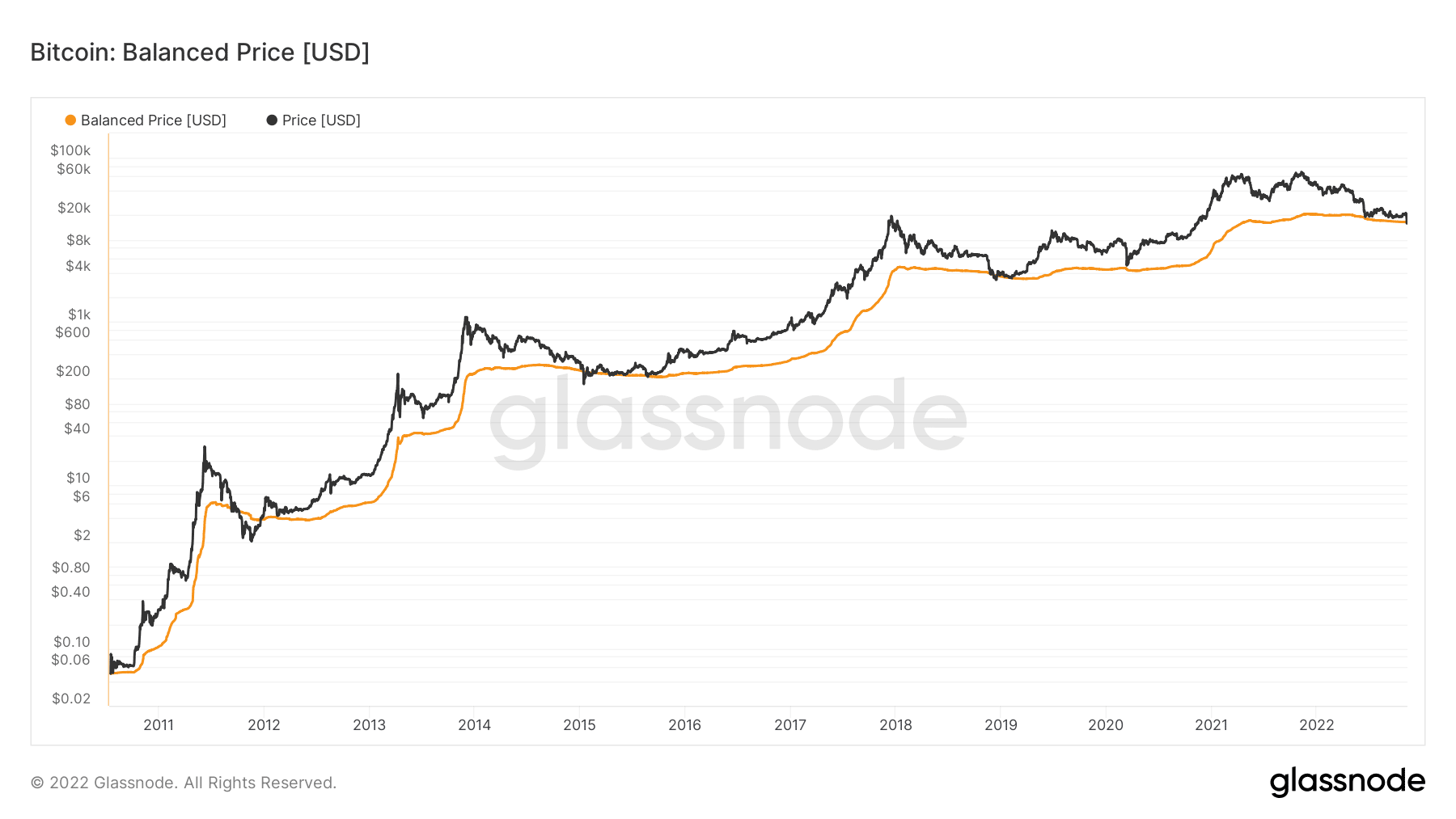

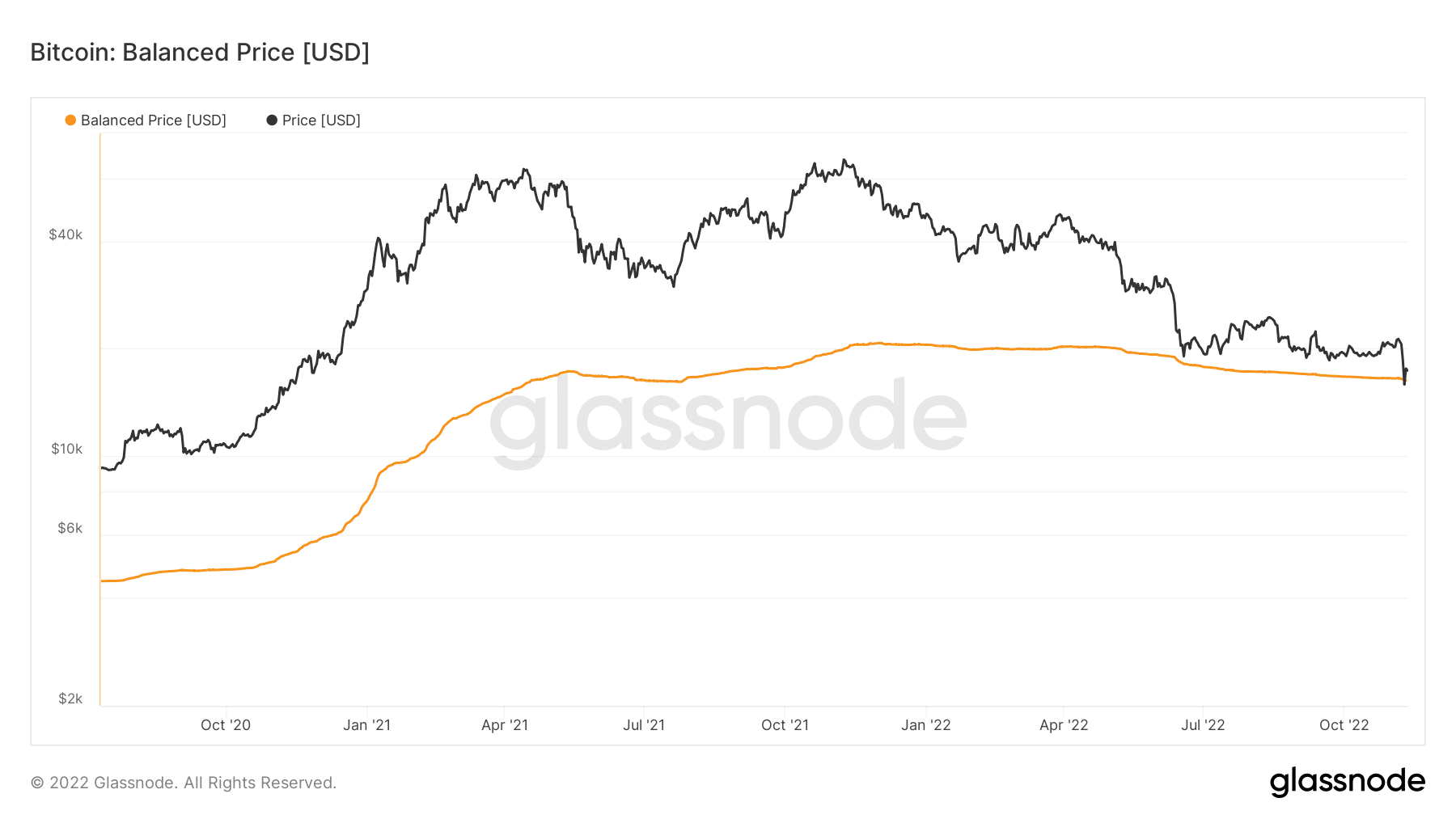

Bitcoin Balanced Price

Balanced price is the difference between the actual price of Bitcoin and the transfer price.

Historically, the price has rarely fallen below this level. It is an indicator used to find bottoms in Bitcoin. According to this indicator, Bitcoin price is at a potential bear market bottom. Here’s a close up view:

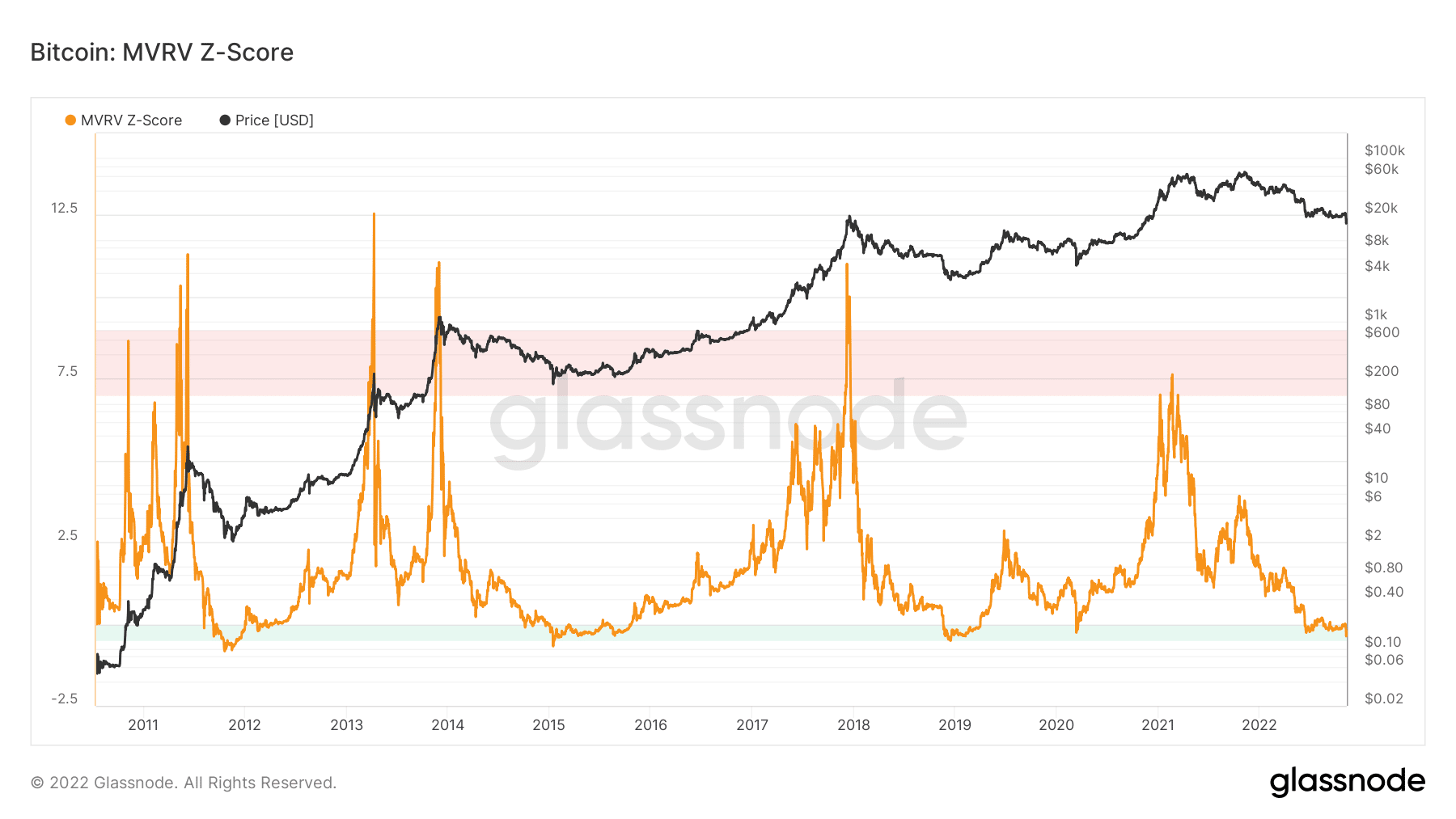

MVRV Z-Score

The MVRV Z-Score indicator, which is prepared by taking into account the behavior of long-term investors, has been in the green zone for about 5 months. When the previous price movements after landing in this region are examined, it is seen that the green zone offers very good opportunities for long-term investors.

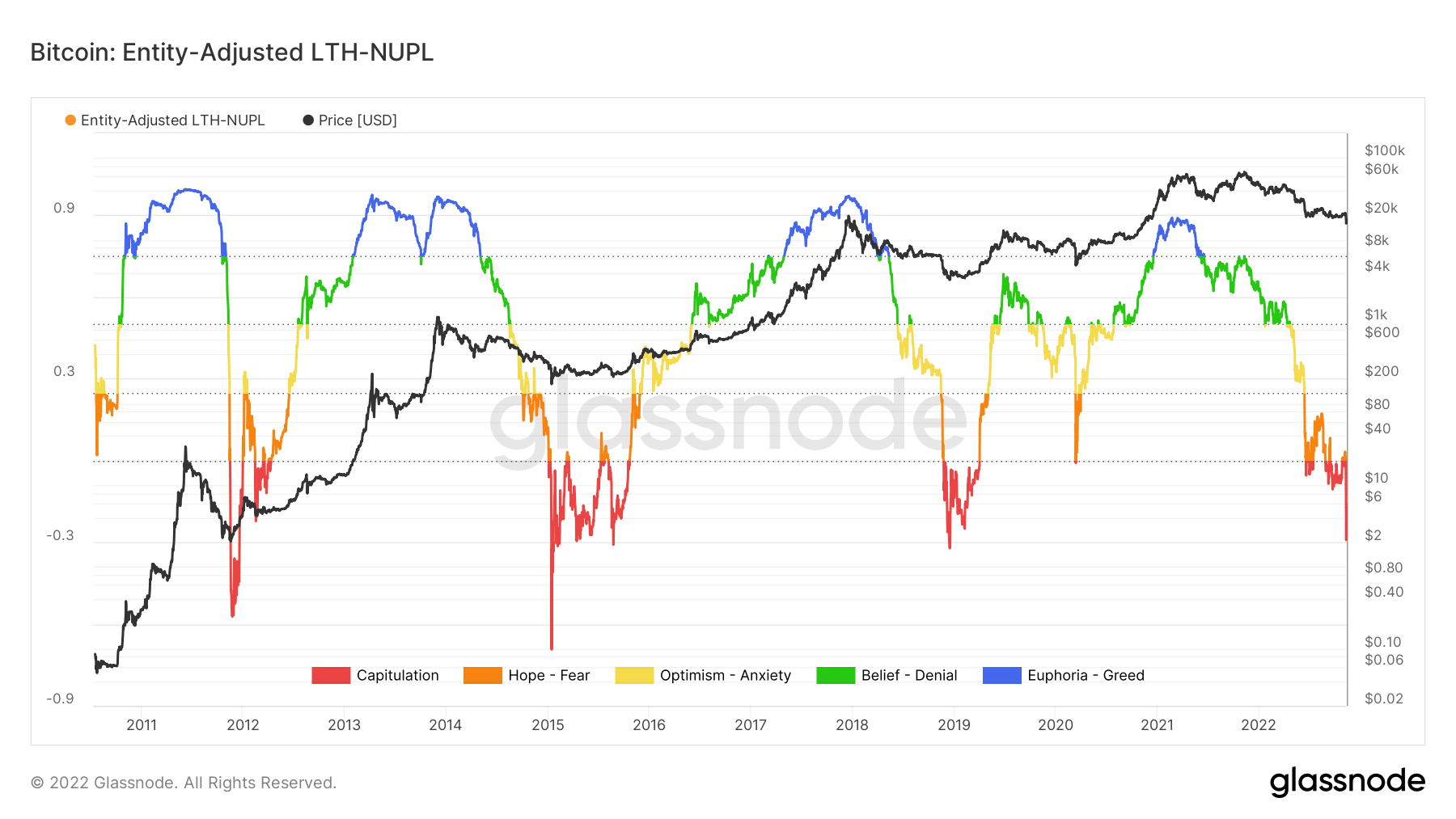

Bitcoin Entity-Adjusted LTH-NUPL

Long-term bitcoin “Entity-Adjusted LTH-NUPL” data, which shows an enhanced version of the unrealized profit and loss situation of their wallets, shows that investors are in the capitulation phase and have surrendered to the market. When we look at the historical data, we see that the capitulation phase is a potential bottom signal.

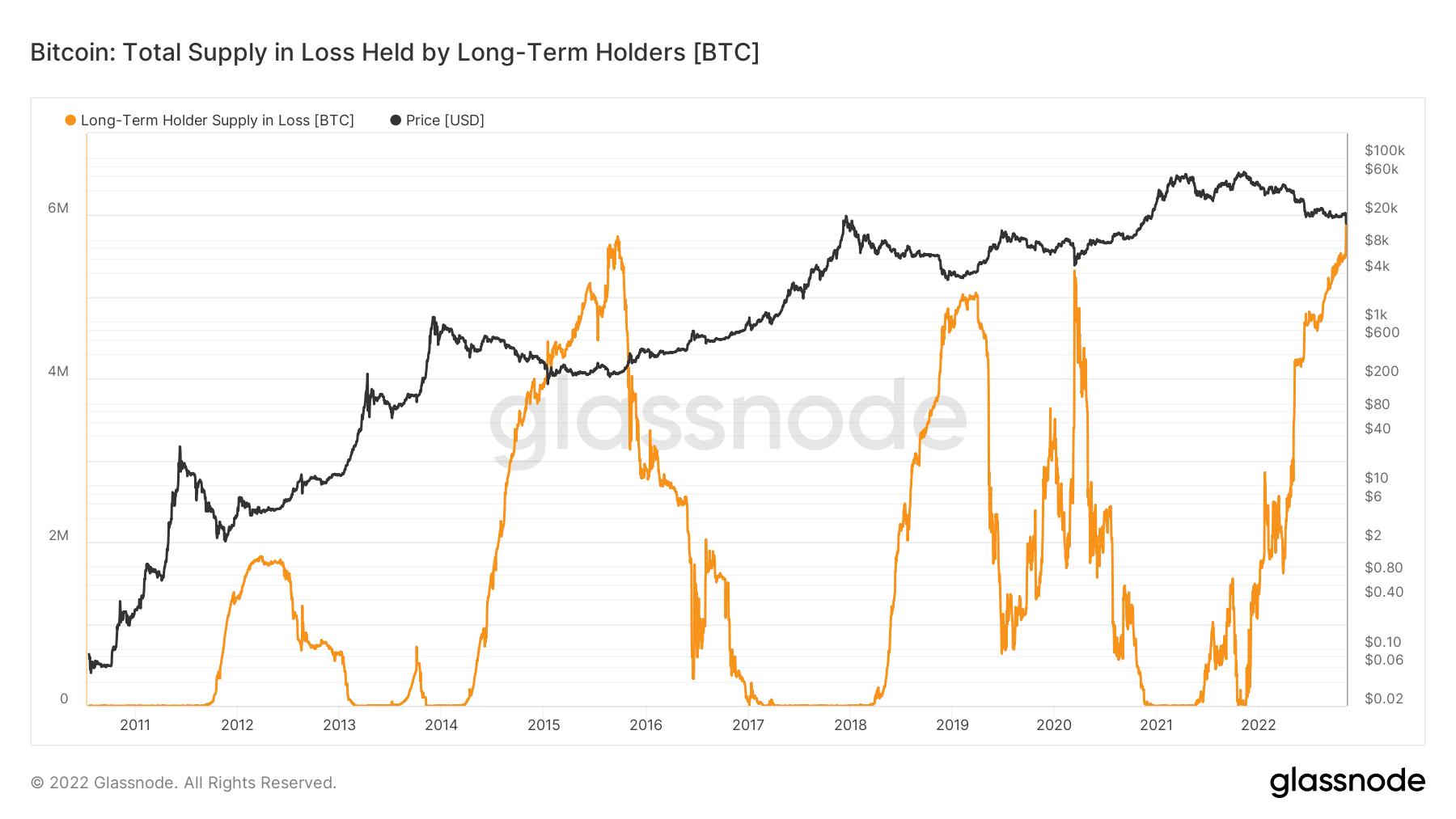

Bitcoin Total Supply in Loss Held by Long-Term Holders

The amount of circulating supply currently at a loss and held by long-term Bitcoin wallets is also close to its historical peaks. We see that the days when the losses of long-term wallet holders peak are a potential bottom signal for Bitcoin.

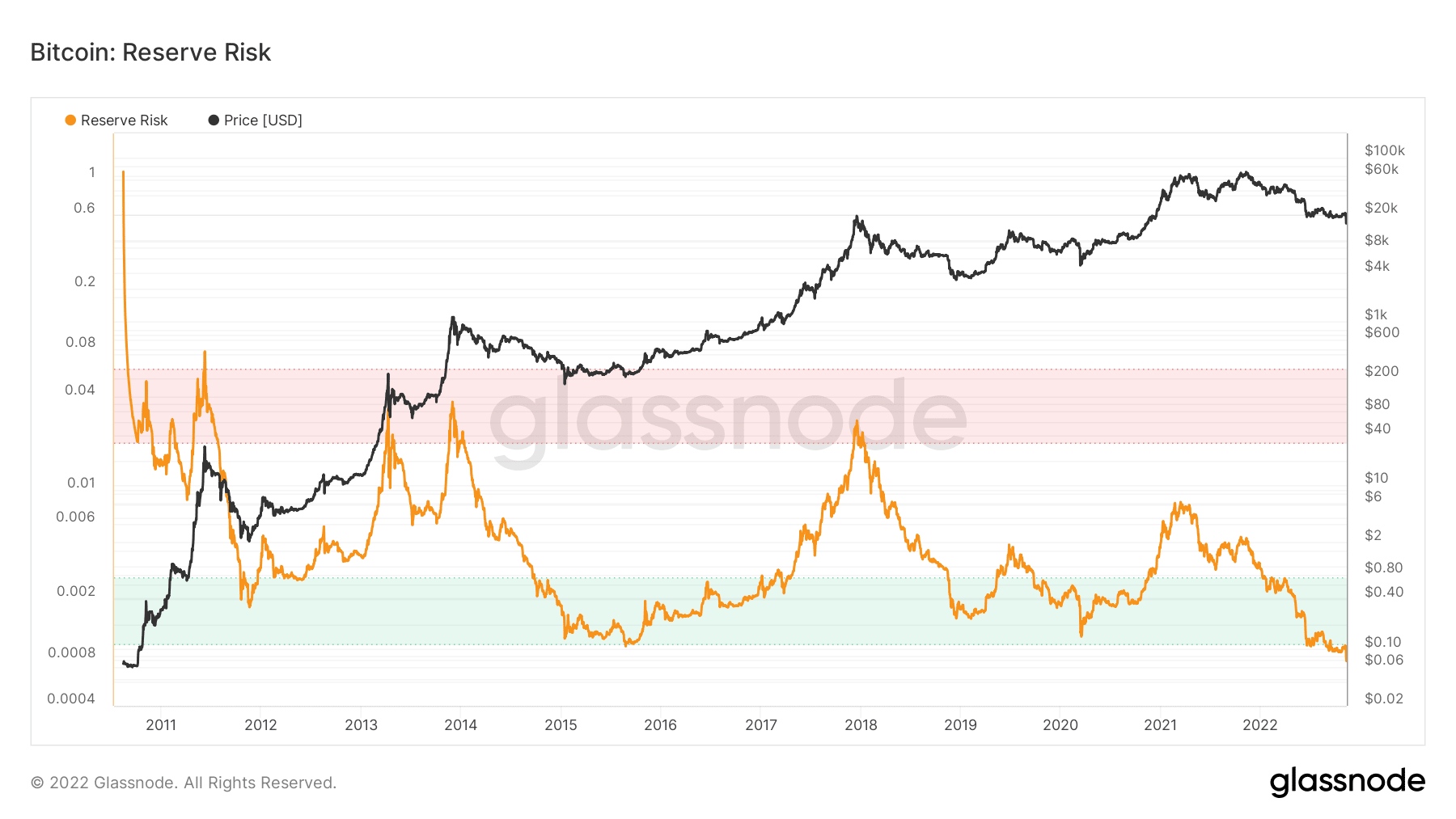

Bitcoin Reserve Risk

bitcoinBitcoin reserve risk has dropped to its lowest level in history, helping us see the risk/reward ratio of long-term investors in . This shows that the risk-reward ratio in Bitcoin has dropped to levels it has never seen before.

It is not easy for us to share these data in these days when the FTX crisis is experienced and its effects cannot be foreseen and fear is at its peak. However, we wanted to remind once again that we are in the historical buying zone for investors who believe in the future of Bitcoin and on-chain analysis.

It is not easy for us to share these data in these days when the FTX crisis is experienced and its effects cannot be foreseen and fear is at its peak. However, we wanted to remind once again that we are in the historical buying zone for investors who believe in the future of Bitcoin and on-chain analysis.

Remember, it is your responsibility to manage your own risk.

*Not Investment Advice.

For exclusive news, analytics and on-chain data Telegram our group, twitter our account and YouTube Follow our channel now! Moreover Android and iOS Start live price tracking right now by downloading our apps!