The world’s largest cryptocurrency with a surprise recovery in the market Bitcoin (BTC)managed to achieve a successful weekly close above $30,000. This was Bitcoin’s first positive close in the last ten weeks.

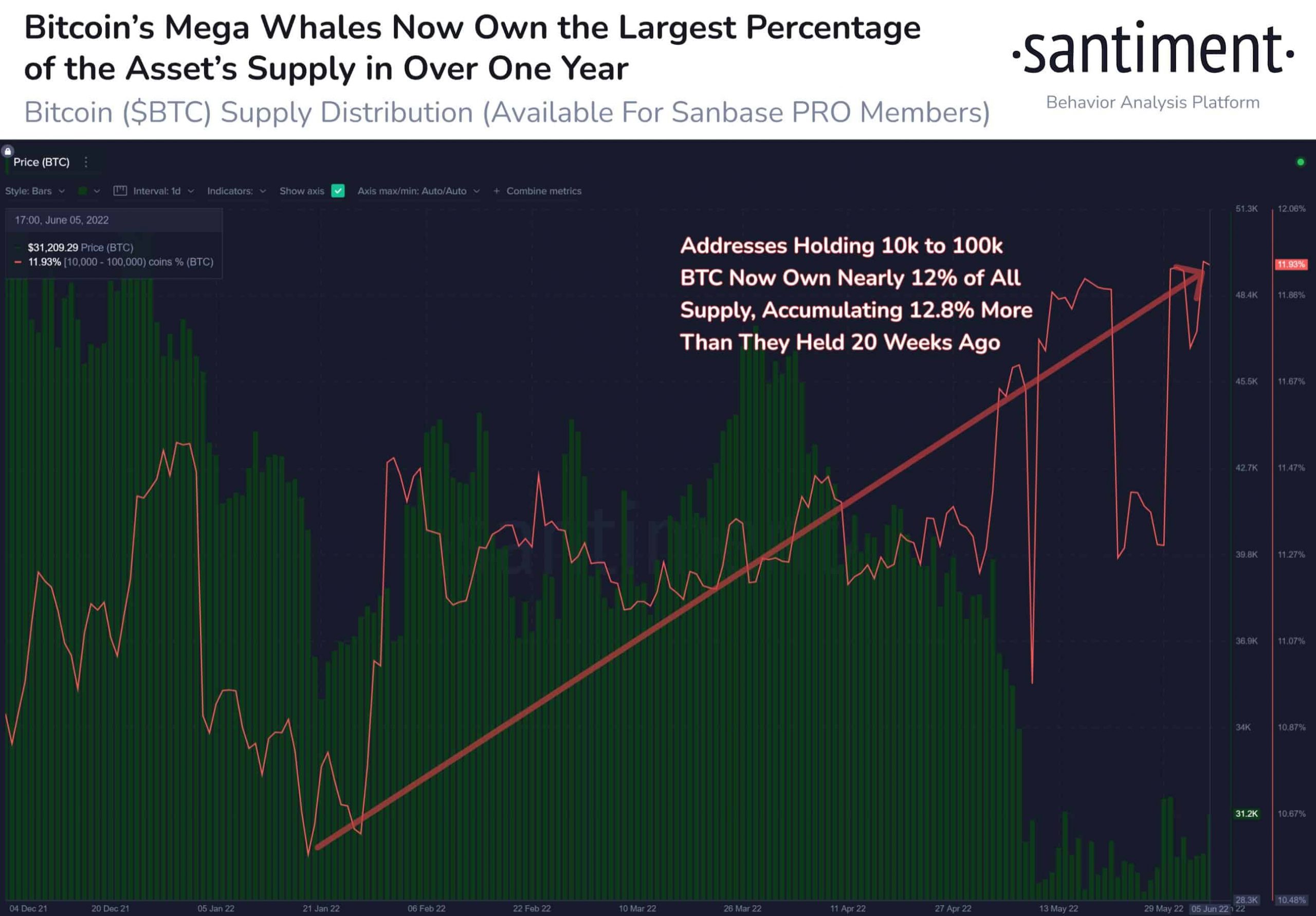

At the time of writing, Bitcoin is trading at a price of $31,427 and a market cap of $598 billion, up about 6 percent. On-chain data provider Santiment states that in light of these developments, Bitcoin’s total whale holdings have also reached a one-month high. The popular platform states that this could be a promising development for the BTC price.

“Bitcoin mega whale addresses, including some exchange addresses, have reached the largest supply of BTC in a year. For alpha, we typically analyze addresses holding between 100 and 10,000 BTC, but backlog from these top-level addresses can still be a promising sign.”

Will Bitcoin Price Increase Continue?

Last week, there was an intense battle between Bitcoin bulls and bears, and as a result, BTC price It continued to fluctuate in a tight range around $30,000. Katie Stockton, co-founder of Fairlead Strategies, commented on the BTC price and said in a note she shared with clients last Friday:

“Bitcoin has stabilized in recent weeks as short-term momentum has recovered. A short-term countertrend buy signal was recorded by Tom DeMark’s TD Sequential pattern, increasing the likelihood of a more pronounced oversold bounce. We expect resistance from the 50-day moving average.”

Bitcoin strongly follows the momentum in the US stock market. However, the crypto market is under pressure due to significant uncertainty in the global economic picture.

This uncertainty drove investors to despair, and even last month, some of the miners started selling their Bitcoins even at these lows to cover their operating costs. This sales move was made by small miners as well as large mining companies.

Cathedra Bitcoin Inc., a small-scale Bitcoin mining company, had to liquidate almost all of its assets to continue its mining operation. Cathedra CEO AJ Scalia said:

“We have spent the last few weeks restructuring our balance sheet and operations to ensure Cathedra is well positioned to withstand a prolonged economic downturn.”

Many economists predict a major economic downturn in the United States over the next 12-18 months. As a result of this situation, experts BTC priceHe talks about the possibility of falling below $25,000 or even more heavily.

You can check the price movements here.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, KoinFinans and the author of this content cannot be held responsible for personal investment decisions.