Bitcoin: I wanted to take a look at the percentage of addresses in profit metric today….

We seem to be at a very important threshold. Of course, we try to evaluate this threshold by looking at Bitcoin’s past movements. These values can show us what kind of psychological threshold the market and those in the market are at or how they feel.

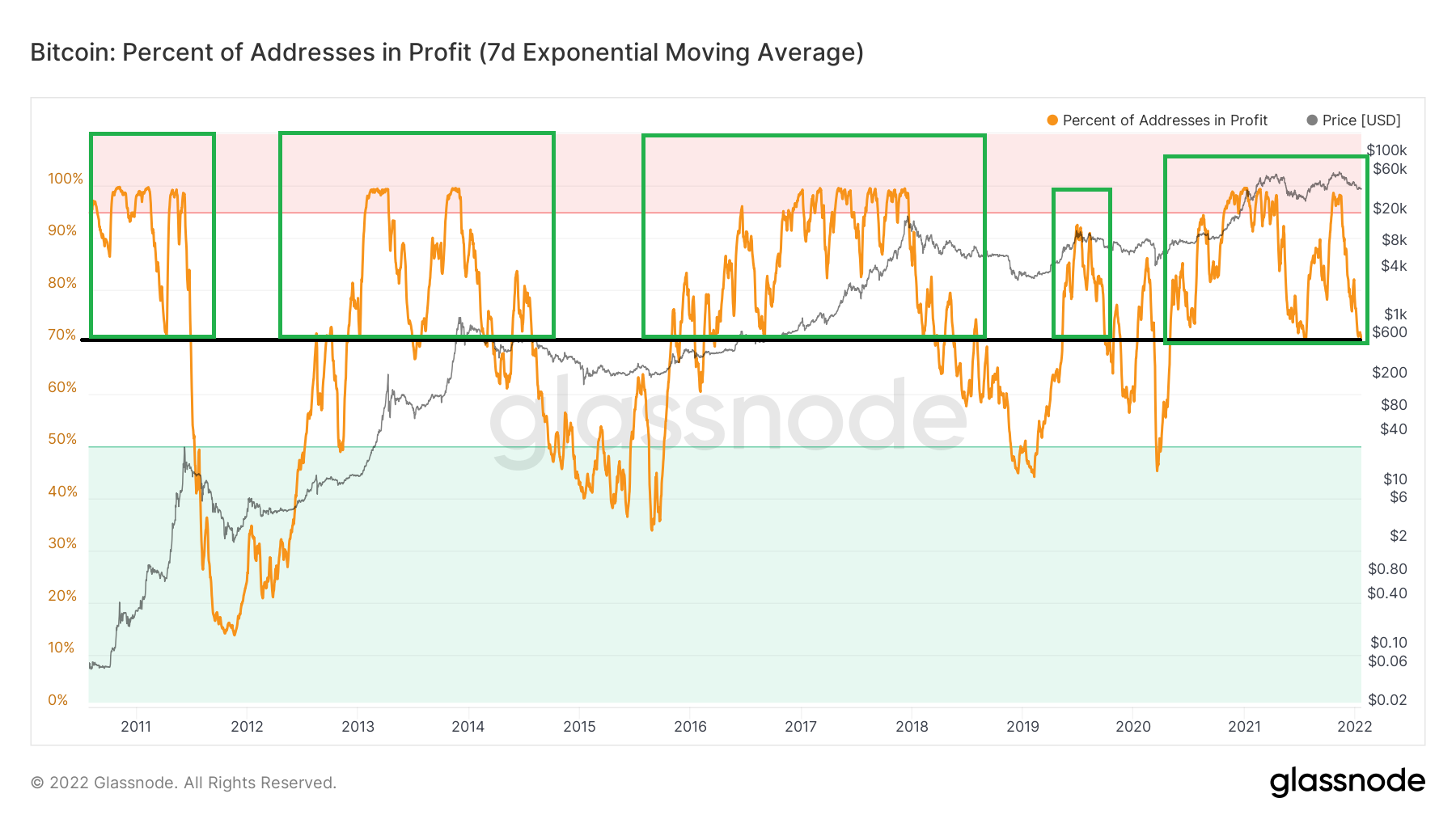

In the first metric below, you’ll see past bull seasons. As I say in every article, 2016 and before are not years comparable to today for me, but let’s look at all the data as of 2011. Because this data will not change much in particular. We will only see a more volatile market movement and sentiment as always.

The first metric shows the days and months of bullish bullishness. Here, there is a serious influx of small investors into the market, and this influx creates times when long-term investors will tend to take profits. Since there is an influx of small investors in the market, prices do not fall despite sales and change of hands, on the contrary, prices rise rapidly, shopping takes place and the market revives.

These are the periods when the market reaches high profitability and everyone who enters makes a profit. You’ll see the same in the metric. The addresses in the profit position changed between 70% and 99% in this period, and whenever the red zone, that is, 95%, is exceeded, the market can no longer meet the profit sales in that region.

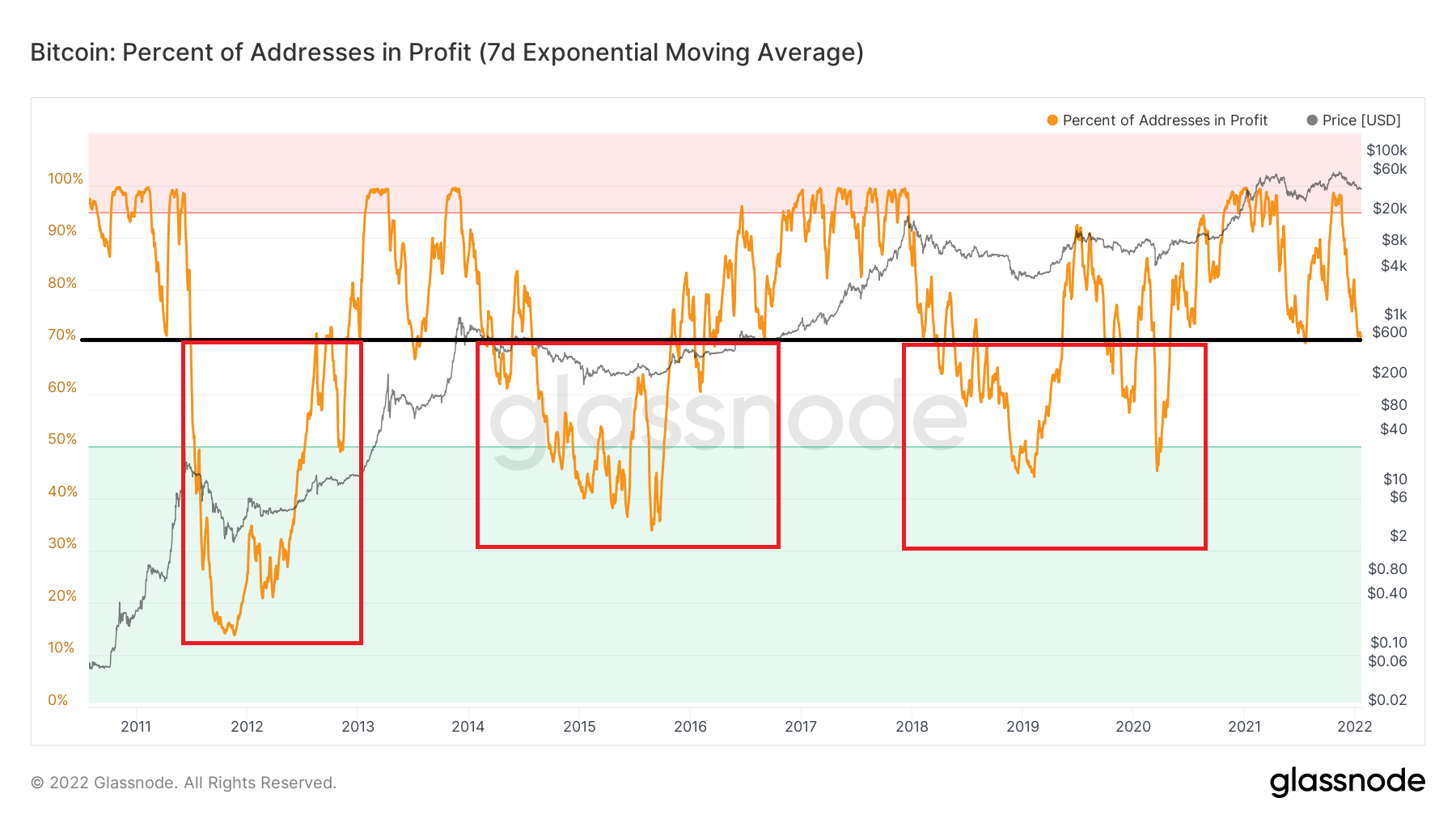

Well, let’s take a look at the second metric, the so-called traditional bear season. I am one of those who think that the old bear and bull seasons will no longer exist and that BTC will move at more stable levels in the long run. Of course, this type of capitulation will still give opportunities, but in shorter periods.

In the metric below, we see the times when the profitability rate of addresses is 70% and below during this so-called traditional bear season.

In other words, the periods when the market does not actually have new investors to meet the sales and this flow is very weak. It seems to me that even though these are the times when real investments will be made and long-term strategies will be established, many new investors are terrified of this traditional bear period promise as they enter during a bull run and invest at high prices.

This is the nature of the market, unfortunately, it is a “0” sum game and while someone wins, someone has to lose, but the important thing is to make the right investments at the right time with the right strategies.

The line I indicated in black in the table exactly coincides with the 70% profitability level, and in the periods below this level, we were able to experience the sharp price movements that we call this capitulation.

That’s why I see such important points as psychological thresholds and pay attention to these data. We started an upward movement from this region again in the May-July fall and now we are visiting the same region again.

Therefore, we are not making any predictions here, but we are passing through periods when risk management must be done correctly. Of course, our hearts want the market to run again from here without waiting, or at least make the July movement again.

But ultimately, it is not our hearts that will decide this, it is all investors in the market other than us, and our job should be to try to take our positions by trying to solve the mood and perception of the market.