Dusseldorf There is no doubt that 2022 will go down in history as the year inflation returned – with a force even pessimists would not have believed possible. The current year will be one of disinflation, i.e. one of falling inflation rates – simply because of the base effects.

There were already indications of this at the end of the year, and the latest data from the USA confirm this trend: In December, price increases in the USA were 6.5 percent, after 7.1 percent in November. The same applies to Europe. In December, the inflation rate in the euro area fell to 9.2 percent.

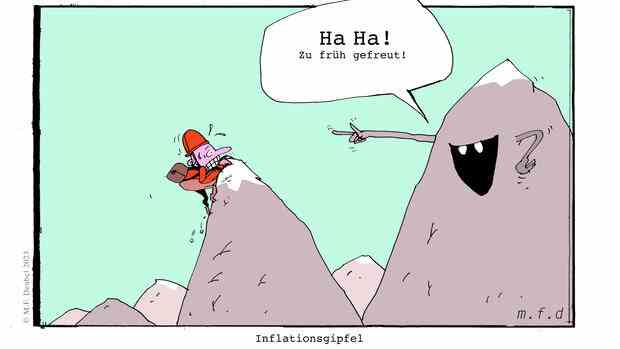

Despite all the joy about this development, this trend is by no means an all-clear for the central banks. Because there is a second trend that should alarm the central banks. The reason for the slowdown in price dynamics over the past few months and presumably also in the coming months is the significant fall in energy prices.

Core inflation, which excludes the strongly fluctuating prices for energy and food and which is the more important benchmark for the central banks, remains at a high level. In the US it is now 5.7 percent, so it remains at a similar level as in the previous month. In the euro zone, it even reached a record value of 5.2 percent in December.

Top jobs of the day

Find the best jobs now and

be notified by email.

That means, however, that the price increase has spread across the board. So there is little reason for the US Fed and the European Central Bank to already announce the end of the rate hike cycle, as some market participants are hoping for. The danger of second-round effects, i.e. high wage demands, which in turn lead to higher prices, is far from over – especially since the increasing shortage of skilled workers in all areas is reinforcing this trend.

The central banks are ultimately responsible for such a scenario. They reacted to the return of inflation, but they reacted late, with the Fed acting far more decisively than the ECB.

Inflation in the world’s most important economy is rising much more slowly.

(Photo: Reuters)

That too can be explained – if not justified. Because in the USA, the price development was and is clearly demand-driven, overheating tendencies played the main role, because the demand – created above all by the rescue packages of the US government – exceeded the supply, which was dampened by disruptions. A radically expansive fiscal and monetary policy inevitably resulted in high inflation.

In Europe, supply was the main problem. The trigger was the Ukraine war – and the associated energy shock. The central bank’s power to act is actually limited here. But even that cannot hide the fact that ECB President Christine Lagarde and her chief economist Philip Lane not only completely underestimated the dynamics of inflation, but also stuck to the myth for far too long that the price increases were only temporary.

The persistence of the core inflation rate at a level that is more than twice as high as the inflation target of the central bank of two percent finally reduces the argumentation of the ECB to absurdity, because the core inflation affects the core business of the central bank without any ifs and buts.

“Inflation is here to stay”

Inflation is here to stay. And the current key interest rate of 2.5 percent will hardly be enough to keep inflation expectations under control, which are so important. The real interest rate, i.e. the interest rate after deducting inflation, is still in the red. If the ECB takes its mandate seriously and wants to regain its credibility, it will have no choice but to raise interest rates further over the course of the year.

ECB President Christine Lagarde promised further rate hikes.

(Photo: IMAGO/Panama Pictures)

In addition, it must finally start resolutely reducing the huge holdings of government bonds in its balance sheet of around five trillion euros – even if inflation rates continue to fall. Because for 2023 as a whole, even the economists at the ECB are expecting a rate of 6.3 percent, after 8.4 percent last year.

The fact that the European Central Bank is trying, albeit late, to bring inflation under control with large, hasty interest rate hikes, while at the same time reinvesting the maturing bonds from its portfolio – i.e. stepping on the brakes and the accelerator at the same time – is not something even experts really want to understand. At best, it can be explained by the fact that with this policy it wants to protect the over-indebted states of Southern Europe from rising capital market interest rates, which is not its mandate.

Italy and France alone account for almost half of the euro zone’s total debt. This total of 5.7 trillion euros is not far removed from the volume of government bonds purchased by the ECB. You really don’t have to be Swabian to feel uneasy about it.

Despite the risk of recession, which must be taken seriously, the following applies to Europe and the USA: Healthy and sustainable management is only possible for companies in the long term if inflation is under control again.

Since the outbreak of the financial crisis in 2007, the central banks have acted as insurers against major macroeconomic risks. In the financial crisis, the euro crisis, the pandemic and now during the energy shock associated with the Ukraine war, money at zero cost from the central banks and overly generous borrowing by the finance ministers were always the means of choice to prevent the worst.

The return of inflation could push the rescue regime to its limits. The bill will come – eventually.

More: Is heating with wood currently cheaper than gas?