A popular analyst and trader has set some pretty hopeful price targets for an altcoin powering a decentralized exchange focused on efficient stablecoin trading.

Using the pseudonym Credible Crypto, the analyst reached 285,600 Twitter followers in August. To Convex Finance (CVX) After a successful entry, Curve said it is ready to make a similar move with the DAO Token (CRV). Credible explained its plan as follows:

“It took us about four months to get 10x the CVX. Now it’s time to get our 10x on the CRV.

The original entry was under $3, with massive additions between $3 and $4. As I’ve stated over and over, I aim for at least $40 at the end of the cycle.

Let’s finish this job!

In his original tweet dated August 18, the trader said that “the world is sleeping on CVX.”

The analyst, who made the same forecast for Convex Finance at the time, said in his original August 18 tweet that “the world is ignoring CVX.”

Since the analyst’s forecast, the Altcoin has been impressive lately, reaching an all-time high of $49 last Thursday, from just under $4 at the beginning of August.

At the time of writing, CVX is tracking steady price action throughout the day despite a crypto market in the reds and is trading higher at $44.03.

Convex Finance, local token CVXused for staking, liquidity mining and voting Curve FinanceIt is a decentralized finance (DeFi) protocol built on top of

Credible Crypto is focused on seeing how high CRV can rise during the current crypto market cycle as it thinks CVX will follow in its footsteps.

After a tweet on Dec. 22 that called for CRV to surpass $5.50 in the short term, Credible said that once the altcoin hits this price target, it could see a correction and possibly return to the support level immediately.

“Target hit. The CRV is showing tremendous strength but if we are to see a pullback, it will likely happen in this region.

Of course we would love to see a breakthrough, but if that doesn’t happen, watch out for the $4.60 zone.”

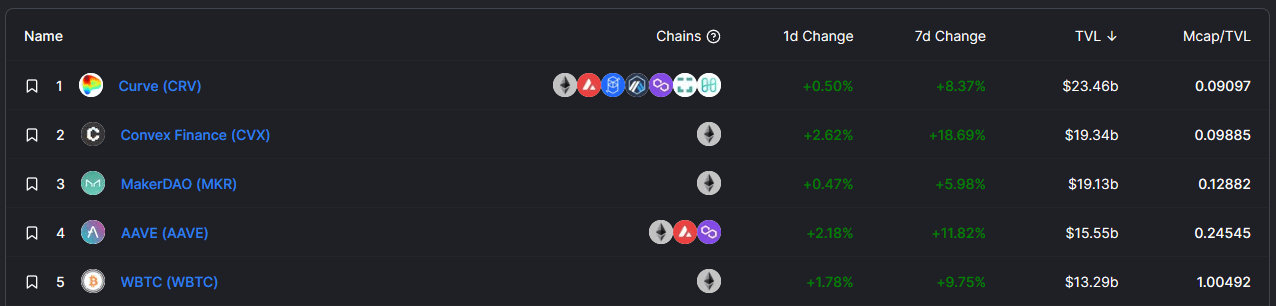

According to DeFi tracker DeFi Llama, Curve ranks first among all projects in terms of total locked value (TVL) of $23.46 billion. Convex Finance is second with $19.34 billion in locked assets.

The TVL of a DeFi protocol represents the total capital held in its smart contracts. TVL is calculated by multiplying the amount of collateral locked into the network by the current value of the assets.

According to data from CoinGecko, the price of CRV slumped as low as $4.67, down close to 15 percent, following the market trend at the time of writing. The altcoin hit a monthly high of $5.85 on Friday after experiencing a massive spike and was up nearly 76 percent from $3.32 in less than two weeks.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.